The few surveys conducted on money creation indicate that the vast majority of citizens are completely unaware of the current.

In the words of the Bank of England : “Most money in the modern economy is created by commercial banks when they make loans” (with equivalent descriptions of the Fed and the Bundesbank ).

Around 95% of money is created as interest-bearing debt by private banks . Miguel Ángel Fernández Ordoñez, the former governors of the Bank of Spain and Mervyn King of the Bank of England during the 2008 global crisis, explain this in their respective books with revealing titles: Goodbye to the Banks and The End of Alchemy .

Creating money as “fairy dust”

Despite money being the lifeblood of the economy, its creation is studied only superficially in economics faculties, is not discussed at all in the media, and is not part of public debate.

German banker and economist Richard Werner provided an empirical demonstration of the process in 2014 , concluding: “This study establishes for the first time empirically that banks individually create money out of thin air as ‘fairy dust’.”

Only a few heterodox economic schools have addressed the issue. The Austrian School of Economics , Modern Monetary Theory , and researchers advocating a system of “sovereign money” (such as J. Huber ), within the International Monetary Reform Movement (with Positive Money as the most influential organization).

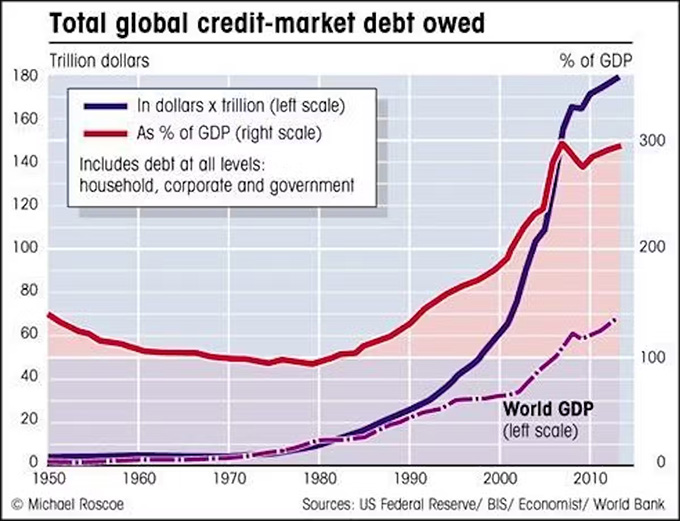

In a system where almost all money is created as interest-bearing debt, the creation of more debt is necessary to pay the interest. This inexorably leads to a spiral of exponentially growing debt. This has been the case since the 1970s, coinciding with the abandonment of the gold standard and the subsequent deregulation of financial markets, as the graph shows.

Global debt currently represents more than three times the world’s GDP. Countries need to grow exponentially to try to repay this unpayable debt, managing, in this case, to pay only the interest due annually at the cost of continuing to borrow ( for example, €31.275 billion in the 2023 Spanish state budget allocated for this purpose ), with no possibility of repaying the principal.

Interest and accumulation of power

In addition to implying exponential growth in debt, interest is the primary mechanism for accumulating wealth and power by private agents who have the power to create money.

The article “It’s the Interest, Stupid! Why Bankers Rule the World” (based on the book Occupy Money by Margrit Kennedy) explains how 35-40% of the price of every product or service we purchase corresponds to interest paid to banks by the agents involved in any stage of production (raw material extraction, manufacturing, transportation, storage, sales, etc.), which logically affects the final price of the product. Even people who have no debt transfer a large portion of their wealth to banks simply because they are part of this monetary system.

You can’t not grow

The ecological and climate change consequences of the current monetary system are discussed in separate reports by Bernard Lietaer and Richard Douthwithe .

First, the system demands exponential growth from countries and companies to service a debt that is growing at this rate . This requires exponential resource production and energy consumption, which in turn leads to the exponential generation of waste in the soil, water, and atmosphere, which is already exceeding the planet’s capacity . In particular, greenhouse gas emissions (primarily CO²) are also driving climate change exponentially .

Banks also have the power to choose who they lend money to, with the sole motivation of maximizing profit. Thus, a large part of the newly created monetary flow is directed toward speculative and polluting activities due to the huge economic benefits they generate. Prominent among these activities are those related to fossil fuels.

The UN document On the Role of Central Banks in Enhancing Green Finance states: “The provision of credit by banks to socially undesirable activities – such as CO²-intensive or highly polluting enterprises – can be characterized as a credit market failure […] Herein lies the discrepancy between the legitimate pursuit of private interests by commercial banks – which create the bulk of the money supply – and the development goals that a society sets for itself.”

Furthermore, the fact that serious environmental problems are subject to the boom-bubble and bust-crisis cycles inherent in a volatile and unstable economy makes it extremely difficult to implement long-term environmental measures and strategies.

Growing inequality

This system leads to ever-increasing inequality in the distribution of wealth. On the one hand, it creates a dominant financial elite that hijacks countries with the weapon of debt, resulting in a lack of real democracy and a lack of control over the large corporations responsible for most energy consumption and the release of waste and greenhouse gases. On the other hand, it generates poverty, misery, and extreme economies among people and countries unable to pay their debts, who lack the time or resources to address environmental issues and climate change.

A possible solution

Various alternative economic models ( degrowth , post-growth , green economy , etc.) are proposed to alleviate the climate and environmental crisis. However, these models will never work on a global scale unless they address the underlying cause of the need for perpetual growth.

One possible solution could be formulated as follows: let the system work as the vast majority of the population thinks it should. Let only central banks issue the new debt- and interest-free money, and let private banks act as intermediaries between the central banks and citizens: managing payrolls, receiving savings, granting loans (with pre-existing money), and charging the corresponding fees or interest for these services.

Similar proposals were already being debated a century ago, such as Irving Fisher’s Chicago Plan , which called for a 100% reserve system (where banks hold 100% of the money they lend). This would control cycles, eliminate bankruptcies, and massively reduce public and private debt. The IMF reviewed this plan in 2012, concluding: “We find support for each of Fisher’s hypotheses.”

Currently there are associations in several countries (grouped in the International Movement for Monetary Reform ) with notable achievements:

- Canada (2011): The Committee on Monetary and Economic Reform (COMER) files a constitutional challenge against Canada’s central bank.

- United Kingdom (2014): Debate in Parliament on monetary creation

- Denmark (2015): Proposal on monetary reform brought to Parliament .

- Iceland (2015): The Government publishes the report Monetary Reform – a better monetary system for Iceland .

- Netherlands (2016): Debate in parliament on monetary creation .

- Switzerland (2018): Referendum on sovereign money .

On the other hand, many central banks are studying and implementing pilot projects on central bank digital currencies and several authors advocate for them (such as Joseph Huber in his book The Monetary Turning Point. From Bank Money to Central Bank Digital Currency (CBDC)) .

These proposals represent the current great opportunity for change toward a more fair, democratic, stable, and efficient monetary system that does not require perpetual growth. Only in this way can we address climate change and significantly reduce the enormous environmental footprint on the planet.

Author Bios: Julen Bollain is Professor and Researcher, PhD in Development Studies at Mondragon University, Alvaro Perales Eceiza is a Physicist. Associate Professor at the University of Alcalá and Fernando Valladares is Research Professor in the Department of Biogeography and Global Change at the National Museum of Natural Sciences (MNCN-CSIC)