In June, the Trump Administration took the first step in dismantling the Gainful Employment (GE) rule. Finalized by the Obama-era U.S. Department of Education in 2014, the regulation established thresholds for affordable debt relative to the typical amount graduates of career-college programs earn. But before negotiators sit down to rehash how best to define whether a program leads to gainful employment, members of the public were first given a chance to weigh in on the regulation as it currently stands.

During a public hearing held last month in Washington, D.C., some opponents of GE used the opportunity to point out flaws in the debt-to-earnings (DTE) ratio, thereby calling into question the validity of the rule’s main accountability measure. Representatives from the for-profit college bloc, in particular, argued the GE rule unfairly holds colleges accountable for student borrowing decisions that are outside administrators’ direct control. Furthermore, some cosmetology schools, which as a group had disproportionately failed the final DTE test published earlier this year, complained that the data the Department used did not accurately capture the amount that their graduates were earning. A federal judge has since sided with the American Association of Cosmetology Schools and agreed that the organization’s member institutions need more flexibility to appeal the Department’s calculation.

But like a snake eating its own tail, some leaders from the for-profit college industry have also relied upon other federal measures that they previously worked hard to discredit, in order to prove that student outcomes — and the degree to which a program is affordable — are not reflected in the debt-to-earnings (DTE) measure. In defense of their student outcomes, for-profit college representatives have repeatedly spoken out of both sides of their mouth; first, decrying student loan default and repayment rates as unfair, and then asserting that these measures are true arbiters of program quality once it becomes convenient.

For instance, as proof that her college’s graduates make a sufficient living after graduation to manage the debt they had taken on to pay for classes, Donna Waite, a representative from the Paul Mitchell Schools Franchise Association, pointed to cohort default rates and student loan repayment rates. At last month’s hearing, she said, “Despite the fact that our students had a better-than-average student loan repayment rate, when the gainful employment assessments were sent out by the Department of Education, 58 of our 112 Paul Mitchell schools had a program in the zone or failing. Put another way, our student default rate in 2013 was 10.6 percent. Clearly, if our graduates are repaying their loans, they’re not being hurt by the cost of the education we provide.” Waite’s arguments echo similar ones made over the past several years. While negotiating the rule in 2014, another commenter claimed that since default rates aren’t closely associated with debt-to-earnings ratios, the GE benchmark doesn’t provide a true measure of affordability.

How Different is the Student Loan Repayment Rate from the Debt-to-Earnings Ratio?

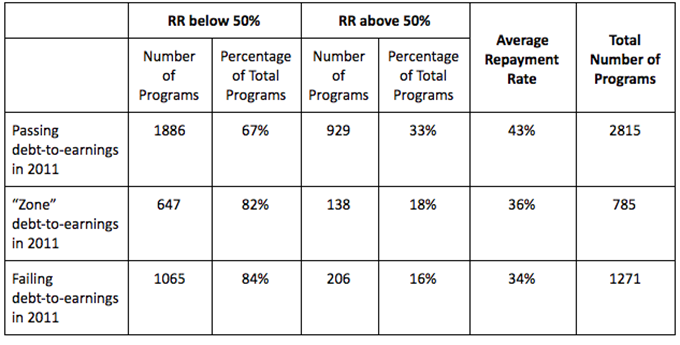

Despite these claims, 2011 gainful employment data (the most recent year of publicly-available program-level repayment rates for reasons discussed below) demonstrate that the debt-to-earnings ratio is closely correlated with program-level repayment rates.* The average repayment rate for a program that would have failed was ten percentage points below those that would have passed. Furthermore, while 929 passing programs had a repayment rate above 50 percent, only 206 failing programs met this criteria. But while there were clear differences in program-level repayment rates between those that would have passed and those that would have failed, it’s true that a non-trivial 16 percent of programs that stood to fail also had a repayment rate above 50 percent. Certainly an accountability measure tied to repayment rates could render several surprising winners and losers.

How Could a College or Program Have a High Repayment Rate and a Failing DTE Ratio?

It is no surprise that some colleges or individual programs may perform well on one measure but fail another. For example, while closely related, colleges with high rates of student loan default may also have better than average repayment rates, or vice versa. Likewise, a program that fails the annual DTE ratio may instead pass another DTE measure that uses a borrower’s discretionary income. Similar slight disparities between repayment rates and a debt-to-earnings ratio are therefore to be expected. Repayment rates offer a helpful check on how well students are faring with their loans, and how well institutions are managing taxpayer dollars, regardless of how much their graduates reportedly go on to earn in the job market. The repayment rate does not count in the institution’s favor any borrowers who are enrolled in an income-driven repayment plan but are only chipping away at growing interest, or those borrowers in forbearance, who are in good standing while not making any payments. In contrast, the DTE ratios provide a more theoretical measure of whether borrowers on average are making loan payments that are reasonable given their earnings. While closely associated, these measures intentionally track different factors and may therefore produce different results.

What Happened to Program-Level Repayment Rates?

Despite recent comments from some of their representatives, the for-profit college sector is the one primarily responsible for pushing to eliminate repayment rates as a secondary test of gainful employment. When the Department of Education promulgated its original GE rule in 2011 and incorporated program-level repayment rates as an accountability measure, the main for-profit college membership organization, the Association of Private Sector Colleges and Universities (now Career Education Colleges and Universities), successfully took the Department to court. The association argued that the repayment rate measured borrower choices that colleges could not control and that the thresholds set were arbitrary and capricious. As a direct result of this legal challenge, the repayment rate provision was struck from the re-negotiated regulation a few years later when the rule was negotiated a second time in 2014. But when it proves advantageous, some are clearly willing to change their tune and herald student loan repayment rates as a better metric than the debt-to-earnings ratio.

In all fairness, a few for-profit college leaders’ temporary deference to the repayment rate should not be mistaken for full-throated, across-the-board support. Furthermore, given the uphill legal challenges its inclusion could face, the repayment rate is unlikely to make it back into a future iteration of the GE rule as an accountability measure. But the for-profit sector’s own rhetorical inconsistencies, not the federal government’s various accountability measures, could do more to harm their efforts. In what’s sure to be a long road filled with sharp disagreement, Congress and the Department should take note of this rare, albeit muddled coalescence around the utility of the repayment rate.

*In 2011, the Department calculated a GE program’s repayment rate differently than it does in other datasets like the College Scorecard. In the GE repayment rates, the Department adds the principal balance of students who have repaid at least one dollar of the original amount borrowed, and then divides this by the total amount that all students in the cohort borrowed. In the College Scorecard data, a repayment rate instead refers to the percentage of borrowers, who have made any progress on their principal loan amount.