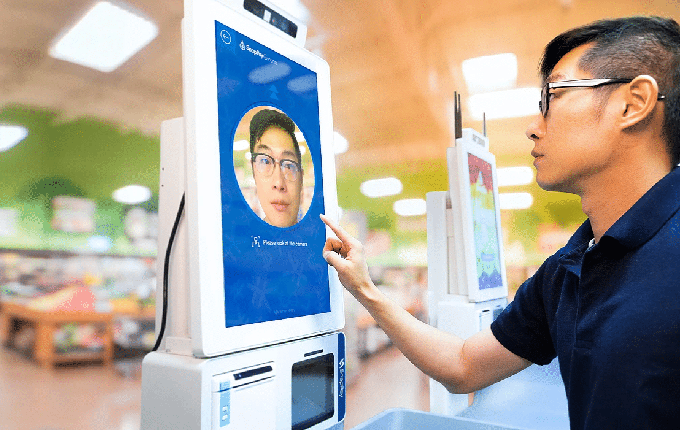

You have probably opened your smartphone using your face. If you have travelled internationally, you have used your face to exit and enter the country. You may have even scanned your face to “verify” your online dating profile. But are you willing to use your face to pay for your morning coffee?

While facial recognition technology isn’t new, facial recognition payment technology (FRPT) is – and it’s growing very quickly.

An estimated 495 million Chinese shoppers used FRPT in 2021 – roughly one third of China’s population. In 2025, financial institutions such as JPMorgan Chase and Japan’s NEC Corporation plan to implement FRPT.

But will Australian and New Zealand shoppers adopt the technology so readily?

The psychology of face payment

Our new research delved into the psychological factors that may encourage shoppers to try FRPT.

According to the basic psychological need theory, people have three basic needs when adopting a new technology: autonomy (a sense of mastery and control over the technology), competence (the sense of integrity, reliability and trust in the technology) and relatedness (a sense of belonging or familiarity with the technology).

We conducted 21 in-depth interviews with potential users to find out what might motivate them to embrace the technology – and what might put them off.

Shoppers’ autonomy and competence were satisfied if they had access to information, considered the technology convenient, trusted the retailer and were offered an incentive. Subsequently, they were willing to trial and adopt FRPT.

Our research participants gained knowledge in multiple ways, including general internet sources, news websites, social media and the retailer itself.

Convenience factors, such as assured fast payments, ease of use and time saving enhanced participants’ competence. As one said:

Yeah, I can see that if [FRPT] does encompass everything, that it probably would be more convenient, and as long as it works first time it would probably be quicker as well.

The brand name, reputation, customer care and regular engagement with the retailer influenced greater levels of trust for shoppers. This in turn affected their FRPT trial intentions. Another told us:

I trust Woolworths more, compared to […] a small shop or not a national brand. Because I believe Woolworths will keep their image, they are going to take care of the customer data and their image.

Finally, promotional rewards such as incentives, discounts or gifts for using FRPT enhanced autonomy and encouraged trialling intention.

Four barriers to adoption

Shoppers were less willing to trial and adopt FRPT if they were not familiar with the retailer, were satisfied with existing payment methods, perceived a lack of assistance, and were concerned about overspending.

When shoppers were unfamiliar with a retailer or brand, they are more sceptical and unsure about FRPT. As one person told us:

If you never heard of it, then you might be a bit sceptical as a whole. [If] I haven’t really heard of this retailer, I haven’t really heard of this system […] what is your purpose for this new technology?

Shoppers were found to have preferred payment methods and these were found to reduce their FRPT adoption due to a reduced sense of autonomy.

I don’t think I’d use it. I think I’d still just like tap my card, or maybe if I had set up my phone properly do it that way.

Physical stores were the most preferred location to trial FRPT, as opposed to online. Within a physical environment, potential users of FRPT could seek support from employees. As one research participant explained:

I definitely think try in a shop first […] I just think if something goes wrong, there is normally someone there that can sort it out.

An interesting finding was the apprehension expressed regarding overspending and compulsive consumption. As one participant explained:

FRPT could be bad because then I’ve got no way of saying “I don’t have money on me”. That is when you always have an open purse […] Yeah, sadly facial recognition is always there.

Privacy and security were a double-edged sword. Some shoppers were willing to adopt if privacy and security were assured. Others were concerned about facial image storage and data breaches. As one said:

I think, compared to a credit card or cash, [FRPT is] absolutely more secure […] Scammers would have to know a lot more about me to fake my face.

While another said:

I do not think I would use it at all. You probably wouldn’t hear if a supermarket got hacked into and all the data leaked, so and that’s out of your control […] I probably wouldn’t trust it.

Calming consumer concerns

Retailers still have a long way to go to convince consumers to make transactions by scanning their faces. Our new research offers some directions forward.

Considering consumers’ concerns about technologies such as deepfakes and other uses of biometric data, retailers should communicate their advanced technology or collaborate with reputable FRPT developers.

Retailers who want to use FRPT need to implement in-store signage, point-of-purchase graphics and on-screen videos to communicate the benefits of FRPT. They should also focus on articulating the convenience elements of FRPT, as well as the security and privacy protocols.

Once they are trialling the technology, retailers will need to deploy extra staff to assist customers, and offer promotional incentives, possibly tied to loyalty programs.

An “alert limit” – in the same way credit card providers limit “tap and go” payment over a certain value – might help mitigate overspending risks.

Author Bios: Gary Mortimer is Professor of Marketing and Consumer Behaviour, Byron W. Keating is a Professor, Shasha Wang is Senior lecturer al at the Queensland University of Technology and Laszlo Sajtos who is a Associate Professor, University of Auckland, Waipapa Taumata Rau