At the end of June 2021, 43 million borrowers – or about 14% of all adults in the U.S. – owed approximately US$1.59 trillion in outstanding federal student loans. Although in many cases the media has focused on borrowers with extremely large balances – such as the orthodontist who owes over $1 million in student loans – the average balance is a more modest $39,351 per borrower with an average monthly payment of $393 per month. The standard repayment period for $39,351 in student loans is 20 years.

The amount of student debt outstanding varies greatly based on the type of degree pursued. The average bachelor’s degree debt is under $29,000 while the average dental school debt is more than 10 times higher at over $290,000. In general, those who pursue careers that pay lower salaries owe less in student debt.

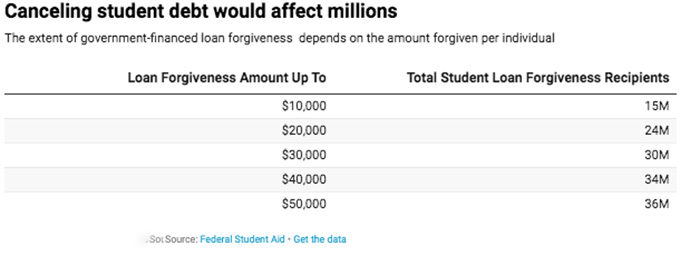

Policymakers have put forth proposals to forgive anywhere from $10,000 to $50,000 or more per borrower.

President Biden has stated that he is “prepared to write off a $10,000 debt,” but not $50,000.

If up to $10,000 per borrower were to be canceled for all 43 million student loan borrowers, the cost would be $377 billion. This would completely eliminate the student loan balances for over 15 million borrowers. The total cost of forgiving up to $50,000 for all 43 million borrowers would be just over $1 trillion. It would also wipe clean the student loan balances for over 36 million people. Some limited student loan forgiveness has already begun. The Biden administration has canceled a combined nearly $3 billion of student loans for 131,000 borrowers who either had been defrauded by their school or have a total and permanent disability.

The effects of loan forgiveness

Some economists view the staggering amount of outstanding student debt as a drag on the economy. These economists argue that any forgiveness of student debt will stimulate the economy. However, I and other economists argue that any boost to the economy from student loan forgiveness would be small compared to the cost to taxpayers.

If $10,000 per borrower is forgiven, it is not as if the borrower is receiving $10,000 that they can go out and spend today. Rather, it is estimated this would free up only about $100 per month for the average borrower to spend or save over 10 years. If all $1.5 trillion in federal student loans were forgiven, the average borrower would have an extra $393 per month. It is estimated that the economy would only grow by about $100 billion, or about 0.5%, if all $1.5 trillion in federal student loans were canceled. For perspective, it would be like making $20,000 a year and getting a one-time raise of $100 for a new salary of $20,100, but it costs the company $1,500 today to give you that $100 raise.

The immediate economic impact would likely be lower, as the Department of Education is currently allowing 90% of borrowers to not make their required monthly payments through September 2021 due to the pandemic.

Since most borrowers are already not making payments on student loans, the financial benefit may already be reflected in the current level of economic activity.

Overall, the evidence suggests that broad-based loan forgiveness may have a modest positive impact on the economy. It is estimated that every dollar of student loan forgiveness translates to only 8 to 23 cents of economic benefit. By comparison, the stimulus checks had an estimated economic benefit of 60 cents for each dollar sent to taxpayers.

Eliminating some or all student debt may help with other issues beyond the economy. Borrowers may delay marriage or buying a home because of the amount of student debt they owe. The student debt burden has been shown to be the cause of mental and physical health problems and “less overall satisfaction with life.”

Uneven benefits

One criticism of forgiving student debt for everyone is that most of the benefits will go to those with higher incomes. In addition, relatively few of the benefits would go to those who borrowed to finance an undergraduate education. Sixty-eight percent of those who took out student loans for a bachelor’s degree borrowed less than $10,000.

Only 2% borrowed more than $50,000. Borrowers with the highest loan balances tend to have graduate degrees earning higher incomes. Households with incomes above $74,000 owe nearly 60% of the outstanding student loans.

If the idea behind loan forgiveness is to stimulate the economy, I believe loan relief should be targeted to those most likely to spend any savings from student loan forgiveness. This suggests student loan forgiveness should be targeted to those with low incomes, who typically have less than $10,000 in student loan debt but are more likely to default on those loans.

Any student loan relief program should consider the effect it may have on borrowers, as student debt impacts some groups more than others. For example, women owe approximately two-thirds of the outstanding student loan debt. About 69% of white college graduates owe student loans, compared to 85% of Black college graduates. The point is that women and people of color would benefit the most from student loan forgiveness.

A matter of fairness

If the government forgives current student loans and then continues to make new student loans, this may lead future students to borrow with the assumption or hope that the government will cancel their loans too.

Unless the underlying issue of the increasing cost of a college degree is addressed, a similar student debt “crisis” may occur again.

Another difficulty of any student loan forgiveness program is the perceived fairness or unfairness of the program. Assume two students pursued the same undergraduate degree, took out the same amount in student loans to finance their education and secured jobs with the same salary in cities where the cost of living is the same. Both borrowers have been making their monthly payments for the last five years, but borrower number 1 made larger payments than required. Because of this, borrower number 1 just completed paying their loan off, while borrower number 2 still has a balance. Is it fair for borrower number 2’s loan to be forgiven? Should borrower number 1 be compensated for paying the loan off early? Lawmakers will need to consider the issue of fairness.

Author Bio: Presidential Fellow at Texas State University